Program Goals

- Professionalization of CAF Finance Officers via CPA Credentialing

- Generate CPA-designated CAF members in the shortest timeline, with the least risk and the greatest chance of durable success.

- Expand RMC’s course offering to include all of the first segment of the CPA curriculum (i.e. “PREP”)

Where do we stand in the CPA designation process?

To become a CPA, candidates must complete the following education:

- an undergraduate degree;

- the CPA Preparatory Program (PREP) which represents 15 undergraduate-level courses if not already covered in the candidate’s undergraduate degree;

- a two-year graduate-level program called the CPA Professional Education Program (PEP);

- the three-day Common Final Examination (CFE); and

- 30 months of practical experience.

Courses Involved

The 15 courses listed in the certificate represent the Chartered Professional Accountant (CPA) preparatory courses which are necessary for entry into the two-year professional program. A 6-week distance-learning option for each course listed here was created. The contents of the compressed online course and its corresponding in-class course are the same.

- BAE/AAF 202

- BAE/AAF 208

- BAE/AAF 302

- BAE/AAF 404

- BAE/AAF 238

- BAE/AAF 300

- BAE/AAF 310

- BAE/AAF 312

- BAE/AAF 242

- BAE/AAF 220

- BAE/AAF 414

- BAE/AAF 420

- BAE/AAF 424

- ECE/ECF 103

- ECE/ECF104

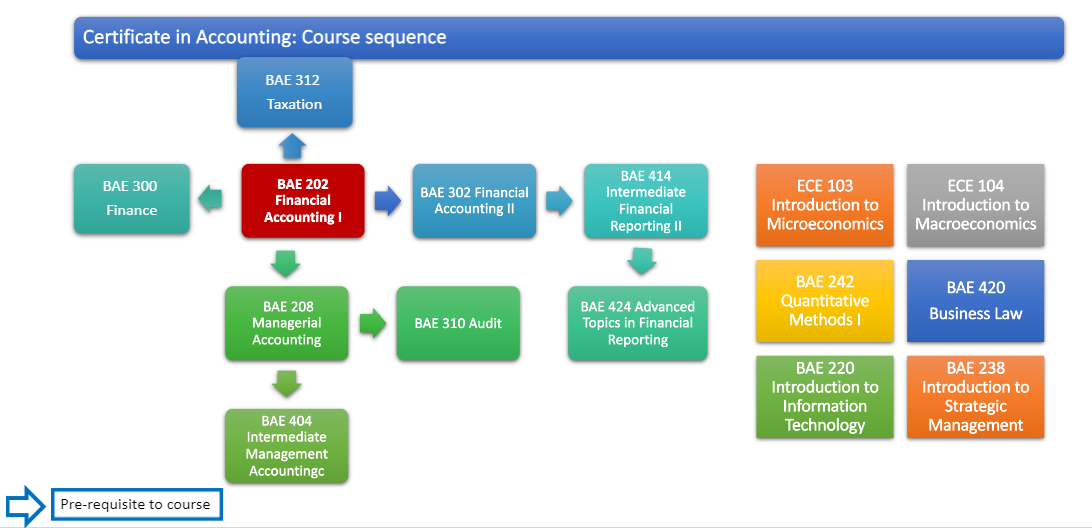

Certificate in Accounting: Course sequence

- ECE 103 Introduction to Microeconomics

- ECE 104 Introduction to Macroeconomics

- BAE 242 Quantitative Methods I

- BAE 420 Business Law

- BAE 220 Introduction to Information Technology

- BAE 238 Introduction to Strategic Management

Points of Contact

Lead Professor:

Nabil Messabia, DBA, CPA, Associate Professor

email: nabil.messabia@rmc-cmr.ca

Administrative Assistant:

Noha Hassan

email: noha.hassan@rmc-cmr.ca